Why 40 Million Homeowners Will Lose Everything in 2026

by

EzekielDiet.com

by

EzekielDiet.comPosted on Jan 08, 2026

Ezekiel Diet Note: This video explains how you could lose your home in the 2026 banking collapse, if you hold a mortgage. Banks, or whoever they sell your loan to, can change the terms of the loan and demand that you pay it off immediately or move out. They can sell your home and use your equity to shore up their loses, leaving you homeless. This has happened in the past.

Some have considered taking out a home equity loan line of credit (HELOC) for the maximum allowed and invest all of it in gold and silver as a hedge against their home mortgage. After the expected escalation they believe they should have enough to pay off the first mortgage, HELOC, 28% windfall taxes, plus extra; or enough to start a new life if the timing is off and they have to walk away from their home. This is not financial advice. It’s conjecture to make you think. Consult with your own legal and financial advisors regarding your personal situation and before using any information from this website.

You’re not about to watch Americans lose their homes because they were reckless.

You’re about to watch it happen because they trusted a system that always collapses the same way.

Right now, a $12 trillion fault line runs through the U.S. housing market — and the pressure is already building. Not slowly. Structurally.

In this video, Ash Finance History breaks down why housing is no longer a “safe asset,” how leverage quietly turns homes into liabilities, and why the same four-stage collapse pattern seen in 1929, the Savings & Loan crisis, and 2008 is now re-emerging — almost frame for frame.

This isn’t speculation.

It’s historical precedent, regulatory data, and balance-sheet mechanics.

In this breakdown, you’ll learn:

Why having 67% of household net worth tied to housing is historically dangerous

How mortgage debt, derivatives, and commercial real estate are tightly interconnected

Why insiders reduce exposure long before prices fall

How the Federal Reserve quietly backstops mortgage markets

What turns slow financial stress into a rapid cascade

Why liquidity disappears before prices collapse

How millions of homeowners who “did everything right” still lost their homes in past crises

Where we are right now on the Leverage Ladder — and what typically comes next

This video explains how debt-driven housing booms actually end, not how they’re marketed on TV.

It’s not about fear.

It’s about understanding mechanics before momentum takes over.

Because when credit freezes, narratives don’t matter.

Only positioning does.

⚠️ IMPORTANT DISCLAIMER

This content is provided strictly for educational and informational purposes only.

Nothing in this video constitutes financial, investment, legal, tax, or real estate advice, nor should it be interpreted as a recommendation to buy, sell, or hold any asset or property.

Real estate and credit markets involve significant risk, including the risk of loss.

You are solely responsible for your financial decisions.

Always conduct independent research and consult qualified professionals before making financial or real estate decisions.

Historical patterns do not guarantee future outcomes.

Subscribe to Ash Finance secrets if you want to understand Historical analysis and patterns

#EconomicHistory #HistoryOfMoney #GlobalFinance #FinancialEducation #MoneyAndPower #history

Featured Videos

MORE ARTICLES

-

Why do ALL governments LIE about space? The Fractured Mind. @Weareallenergy1

Feb 22,2026 5:19 pm

-

Did the Nephilim Look Like Clowns? | Satan’s Little Season Podcast

Feb 21,2026 11:50 am

-

Richard Branson Forgets the Fisheye Camera Lens Proves Flat Earth on Galactic Flight

Feb 21,2026 9:21 am

-

Is AI Ancient? | Satan’s Little Season Podcast

Feb 20,2026 7:55 pm

-

Baal’s Olympics: Moloch Worship, Wexner & The Blackmail Cartel – EyesisWatchin

Feb 20,2026 2:39 pm

-

Satan’s Little Season EZD Recommendation: Little Season Podcast

Feb 20,2026 1:44 pm

-

Was Jesus the King of Tartaria? | Millennial Kingdom | Satan’s Little Season

Feb 18,2026 11:09 am

-

Why Satan Needs Politics – The Little Season is the final sorting stage for the next phase

Feb 17,2026 9:16 am

-

Was there a Mud Flood and Reset? | Millennial Kingdom | Satan’s Little Season

Feb 16,2026 2:39 pm

-

What is the Little Season? | Millennial Kingdom | Satan’s Little Season

Feb 16,2026 1:59 pm

-

What About Everyone Who Lived and Died Before Christ? They’re Back for Their Little Season Test!

Feb 16,2026 1:14 pm

-

SLS: A Bad FAKE Ghislaine Maxwell in Prison for the Real Ghislaine Maxwell?

Feb 16,2026 10:09 am

-

SLS: COMPILATION OF THE DEAD AND DYING FROM TRUMP’S “AMAZING” COVID VACCINE

Feb 16,2026 8:09 am

-

Mike Adams on Seedance 2.0 AI Movies: Is Hollywood Obsolete? Will Netflix DIE?

Feb 14,2026 12:59 pm

-

SLS: Of Course Valentine’s Day is Corrupted in Satanism

Feb 14,2026 11:45 am

-

Why Is the Vatican AFRAID of Sabbath-Keeping Adventists—The Truth Rome Is HIDING

Feb 14,2026 10:15 am

-

The Danger of Seeing What Others Don’t – Carl Jung Original

Feb 14,2026 8:59 am

-

Baby Trump Goes To The Moon With Elon Musk!

Feb 12,2026 6:57 pm

-

What Makes Marriage a Legal Contract That Creates Liability Under Divorce Law?

Feb 09,2026 3:42 pm

-

The Modern Financial Crisis- CBDCs, the Genius Act and the Beginning of the End of the Little Season

Feb 09,2026 2:25 pm

-

Netflix Series ‘Bloodline’ a Textbook Lesson in the Generational Curse

Feb 08,2026 1:25 pm

-

The 6 Million Epstein Files, Designer Babies & The Synthetic Life Plan

Feb 08,2026 10:10 am

-

From the Fringe: The Most Important News – Michael Snyder Daily Feed

Feb 08,2026 8:28 am

-

SLS NWO: Catherine Austin-Fitts warns of Digital ID having total financial control

Feb 06,2026 9:56 am

-

SLS: When the Largest Christian Church Regularly Rapes, Tortures, Kills, & Dismembers Children

Feb 06,2026 9:11 am

-

Catherine Austin Fitts: Agenda 2030 reset; ‘system’ ends by 2030!

Feb 04,2026 11:29 am

-

Billionaires are selling everything: the $50 billion warning sign

Feb 03,2026 4:38 pm

-

Bill Gates SHOCKED As Dell ADMITS Nobody Wants Windows 11 AI PCs TechPoint

Feb 02,2026 9:18 am

-

Dr. Lee Merritt – Very Scary Times Really, The Major Shock That’s Coming

Feb 01,2026 2:44 pm

-

Doomsday Clock, Discombobulator & The Biometric Control Grid – EyesIsWatchin

Jan 31,2026 2:56 pm

-

Why Does Only The Ethiopian Bible Reveal The Hidden Truth About The Teachings Of Jesus?

Jan 31,2026 11:32 am

-

The 9 Mega Banks OCC Rated “Critical” — Wall Street Is Panicking

Jan 30,2026 10:02 am

-

“They Are Keeping This From You” | Whitney Webb

Jan 29,2026 5:43 pm

-

Find Out What the Coming Big Bank Bail-In Is About

Jan 29,2026 11:46 am

-

Safest vs Riskiest: I Ranked America’s Top 20 Banks (Surprising Results)

Jan 28,2026 5:35 pm

-

Credit Unions vs Banks: Which Is Actually Safer Right Now?

Jan 27,2026 6:52 pm

-

Breaking: The OCC Just Downgraded 47 Major Banks — Here’s The List They Don’t Want You To See

Jan 26,2026 9:47 am

-

Warren Buffett: The 5 Safest Banks in America Right Now

Jan 26,2026 9:34 am

-

Did Satan’s “Little Season” Begin in 1776?

Jan 25,2026 4:02 pm

-

Life is a Test Part 2 – Works. What is expected of us in the Little Season?

Jan 25,2026 2:48 pm

-

Why The Titanic Sinking Was The Final Step to Create The Federal Reserve

Jan 23,2026 6:27 pm

-

Finally, Something Very Interesting: Gog & Magog – The final Battle against the Saints

Jan 22,2026 8:08 pm

-

Walmart Caught Using Padded Weights to Overcharge for Meat?

Jan 22,2026 4:16 pm

-

VAX A NATION: Public Premiere “EVERY single vaccine has an excipient that is a human toxin.”

Jan 22,2026 2:06 pm

-

The Financial Endgame, Silent Weapons & Cognitive Warfare – EyesIsWatchin

Jan 22,2026 12:53 pm

-

Little Season Eschatology is Not Preterism

Jan 21,2026 10:56 am

-

The Hidden Link Between Parasites and Diabetes They Never Told You

Jan 20,2026 5:13 pm

-

NASA’s OPERATION BLUE BEAM EXPLAINED

Jan 20,2026 7:55 am

-

Health reform: 7 nighttime bad habits destroying your health

Jan 19,2026 6:45 pm

-

Ezekiel Diet Friendly Deals: Kroger Simple Truth Organic Sprouted Grain & Legume Bread

Jan 19,2026 3:34 pm

-

The Depopulation Agenda Fits The Satanic Directive To Lie, Kill, Steal, & Destroy

Jan 18,2026 6:27 pm

-

Tartaria Lost Children and the Vanished Adults – The Truth Behind the Orphan Trains

Jan 17,2026 12:02 pm

-

Stolen Healing Med Bed Technology: The 19th & 20th Century Directive to Lie, Kill, Steal & Destroy

Jan 16,2026 10:14 am

-

“We’ve never seen anything like it, blood pouring out of our faces” US Directed Energy Weapons

Jan 15,2026 10:31 am

-

AI Explains The Nefarious Purpose of 5G Frequency

Jan 14,2026 8:51 am

-

The New Dietary Guidelines Quietly Admit They Were Wrong (Here’s the Proof)

Jan 12,2026 10:33 am

-

Regime Change 2.0, Blackouts on Command & 2026 Psy-Ops Accelerate

Jan 11,2026 8:34 am

-

Anti-Humanists Push CENSORSHIP So They Can Get Away with DEPOPULATION

Jan 10,2026 6:19 pm

-

Days of Noah: What They Don’t Tell You About the Population

Jan 09,2026 10:36 am

-

Why the US Wants to BUY Greenland (It’s Not a Joke)

Jan 08,2026 6:29 pm

-

5 Assets They Will Seize First in a Crisis (And How To Hide Them)

Jan 08,2026 4:40 pm

-

Why 40 Million Homeowners Will Lose Everything in 2026

Jan 08,2026 3:06 pm

-

Who are the Rest of the Dead from Revelation 20:5?

Jan 07,2026 11:06 am

-

This Ancient Code Reveals EXACTLY How Your Words Control Reality… The Universe Obeys This

Jan 06,2026 4:17 pm

-

Why BlackRock Just Moved $2.1 Trillion Out of America (And What It Means for You)

Jan 05,2026 6:53 pm

-

Very Interesting: The Little Season is a Test – Part 1 – Deception

Jan 05,2026 6:26 pm

-

Baby Trump: I Stole the President and Took Over Venezuela

Jan 05,2026 11:09 am

-

Charlie Munger: Don’t Buy a House — Here’s What I Did for 30 Years

Jan 05,2026 9:33 am

-

AI-AI-Oh-No: They Said AI Would Replace You By Now – Exposing AI Grifter Lies

Jan 05,2026 9:09 am

-

What I Believe After 20 Years and 36,000 Hours of Matrix Research at 5 Hours a Day

Jan 05,2026 9:06 am

-

MORGAN STANLEY MEMO LEAKED: Exit All Silver Positions Before Month End?

Jan 04,2026 12:46 pm

-

Put a Missionary on the Payroll Spotlight: Dan & Elaine Lancaster – Every Home a Lighthouse

Jan 04,2026 8:44 am

-

Trump’s Israel Prize, Epstein Slop, Israel’s AI Takeover & The Next Plandemic

Jan 03,2026 11:13 am

-

Why the USSR Declared War on Tartarian Bells — The Sound They Couldn’t Allow

Jan 03,2026 8:25 am

-

Researched Flat Earth for 3 Years – Part 14 – The Satellite ‘Mystery’

Jan 02,2026 3:02 pm

-

A message for those awakened from the matrix

Jan 02,2026 12:42 pm

-

Michael Snyder: 10 Very Important Trends To Watch As We Enter 2026

Jan 02,2026 11:38 am

-

2026: YEAR OF THE FIRE HORSE & BOLSHEVIKS – Reinette Senum

Jan 02,2026 9:04 am

-

THE HUMAN ANTENNA (2025) ▪️ DEATH VAXX DOCUMENTARY

Dec 29,2025 12:43 pm

-

Should You Remove The SIM In Your Car?

Dec 28,2025 11:55 am

-

Mechanics Tested Major Gas Stations and One Hidden Finding Is Destroying Engines Nationwide

Dec 28,2025 10:22 am

-

The Bells They Took – How 1914 Silenced Tartaria’s Hidden Technology

Dec 28,2025 9:30 am

-

[Mar 14, 2020] Coronavirus Caused By 5G

Dec 27,2025 3:03 pm

-

AI Found Millennial Reign References in Vatican Archive? Little Season Researchers Threatened?

Dec 26,2025 8:46 pm

-

The Little Season – Why does the church not teach it? Why does the world try to hide it?

Dec 26,2025 6:28 pm

-

How December 25 Became Christmas

Dec 24,2025 5:00 pm

-

Your Guide to 5th Generation Warfare

Dec 24,2025 2:43 pm

-

Greenland News: The Fight To Surround The Camp of the Saints

Dec 24,2025 11:16 am

-

When The Congregation Has More Holy Spirit Discernment Than The Pastor

Dec 24,2025 9:37 am

-

Who Played The Leading Roll in U.S. White Birthrate Decline?

Dec 22,2025 9:22 am

-

‘Jesus is the Lord’

Dec 22,2025 6:47 am

-

Bondi Beach, Venezuela WMDs, UBI Control System & the Super Flu Script – EyesIsWatchin

Dec 21,2025 9:04 am

-

Suggested Auto Strategy: 17 Habits to Make Your Car Last Over 500k Miles Without Repairs

Dec 20,2025 11:48 am

-

How They Broke us All – Warning Graphic

Dec 19,2025 4:59 pm

-

I Researched Flat Earth for 3 Years – Part 13 – Rocket Truth Revealed [Mystery Teachings]

Dec 19,2025 10:30 am

-

Pharma Thriving off Gluttonous People – Are All Injectables Depopulation Weapons?

Dec 18,2025 3:07 pm

-

Dr. Tau Braun: Vaccines, Bioweapon Science, and the Hidden Role of Copper in Immune Collapse

Dec 18,2025 2:31 pm

-

NWO: Jesuit Anthony Fauci says the next outbreak will be a respiratory disease

Dec 18,2025 1:50 pm

-

Should We Be Playing With Satan’s Toys? Technology is Witchcraft in this Little Season.

Dec 14,2025 6:43 pm

-

FDA Bombshell, UK Speech Crackdown & Imminent False Flag – EyesIsWatchin

Dec 14,2025 10:38 am

-

How AI Takeover Could Happen In 2 Years: A Scenario

Dec 13,2025 6:21 pm

-

19th Century Asymmetric Wars: Who Was Really Being Wiped Out Worldwide?

Dec 13,2025 10:56 am

-

1/2 Cup per Day to Fix Insulin Resistance & Shrink Belly Fat | Dr. William Davis

Dec 11,2025 6:28 pm

-

AI Blackouts, Klaus Schwab’s Intelligent Age & The Bi-Partisan Psy-Op – EyesisWatchin

Dec 09,2025 6:15 pm

-

DeFlock.me: You Are So Flocked – See Where All The Flock Tag Cameras Are In Your Area

Dec 07,2025 10:07 am

-

38 Trillion to Digital Prison: UBI, AI & the Rockefeller Beast Machine – EyesIsWatchin

Dec 07,2025 9:02 am

-

Baby Trump’s Alaska Christmas Tree Adventure Goes Wild!

Dec 07,2025 8:39 am

-

Anjelah Johnson-Reyes Learns About The South | Say I Won’t

Dec 06,2025 4:38 pm

-

Diaper Diplomacy: “All these white bales are not Christmas gifts from Santa.” | Hegseth

Dec 06,2025 4:32 pm

-

250,000 Orphans VANISHED: The 19th-Century Disaster They’re Covering Up — Trains & Mud Flood Theory

Dec 05,2025 8:38 pm

-

This Is The Catastrophe That Forced Humanity to Start Over in 1700

Dec 04,2025 6:27 pm

-

Rise of the Safety State | Greg Reese

Dec 04,2025 9:10 am

-

A Brave New 1984: How We Learned to Love the Cage | Humanly Curious

Dec 03,2025 11:01 am

-

Put a Missionary on the Payroll Spotlight: TCM-USA Office Staff – Things To Come Mission

Dec 03,2025 9:22 am

-

Leaked: FBI “Scrubbed” Trump From Epstein Files (The Cover-Up)

Dec 02,2025 7:01 pm

-

Fake Space Mistakes: THE CHINESE DIDN’T GET NASA’S MEMO

Dec 02,2025 4:18 pm

-

Project Blue Beam: NASA & UN’s Plot to Fake an Alien Invasion & the Second Coming

Dec 01,2025 5:45 pm

-

Who Are We – The Little Season Slaves? The Population Explosion at Beginning of the Little Season.

Dec 01,2025 10:12 am

-

POV: What You Would See During an AI Takeover

Nov 30,2025 9:42 am

-

Rick Rubin and The Occult Secret Behind AI Music

Nov 30,2025 9:37 am

-

How to Hide in Plain Sight: Next-Level Digital Privacy

Nov 30,2025 9:32 am

-

Trump’s Plan to Bring Back the Gold Standard (The Hidden 2027 Reset)

Nov 30,2025 9:28 am

-

The Zionist Blueprint: The Protocols of Zion – A forgery or real? You Decide

Nov 29,2025 3:55 pm

-

Diaper Dumps: Baby Trump

Nov 29,2025 2:27 pm

-

2 Days until Nationwide Facial Recognition-Surveillance with Ring and Flock

Nov 29,2025 1:37 pm

-

NWO: Dr. McCullough says 71% of people found dead at home was due to COVID-19 vaccine!

Nov 28,2025 11:24 am

-

The 2026 AI Crash: Why Nvidia, Microsoft & AMD Will Fall 65% Simultaneously

Nov 27,2025 7:49 pm

-

Jason Jack: Did the Thanksgiving holidays originate during the Millennial Reign?

Nov 26,2025 9:47 am

-

Rush Limbaugh 2010: Socialism Nearly Killed The Pilgrims

Nov 26,2025 8:50 am

-

The Origin of Thanksgiving Foods & Today’s Lab Coat GMO Bigger Better Tastier Versions

Nov 26,2025 8:00 am

-

7 Easy Ways to Avoid Holiday Weight Gain – And Have a Great Time Doing It

Nov 26,2025 7:31 am

-

3I/ATLAS Psyop Update: Michio Kaku Warns 3I/ATLAS Could Be ALIEN Tech (And NASA is WRONG)

Nov 25,2025 7:06 am

-

The Little Season, The Last Battle + The Camp of the Saints

Nov 23,2025 4:51 pm

-

The Golden Age Commercial Real Estate Collapse Of America— The Hidden 2026 Crisis

Nov 23,2025 11:24 am

-

Engage Proverbs 27:12 NOW: The Hidden Cycle That Predicts 2026 Crash

Nov 23,2025 10:49 am

-

Why Your Savings Are Trapped: The Golden Age 2026 Collapse verses 1929 Collapse

Nov 23,2025 9:55 am

-

Billionaire Bunkers: What Does Silicon Valley Know About The End of The World?

Nov 22,2025 2:33 pm

-

Evidence That Jesus & The Saints Already Completed The Millennial Reign

Nov 22,2025 7:08 am

-

Avi Loeb on 3I/ATLAS Image Reveal: Did NASA Just Try to Gaslight Us with a Blurry Photo?

Nov 22,2025 6:43 am

-

Millennial Kingdom Theory: Camp Of Saints Is Still Here?

Nov 21,2025 6:36 pm

-

The Golden Age of Silent Collapse: Why Dealerships CAN’T SELL CARS in 2025

Nov 21,2025 2:17 pm

-

Jason Jack – Short Season Eschatology: Who are the “Four Horsemen” of Revelation 6?

Nov 21,2025 12:13 pm

-

Millions of Christians were fooled with the ‘Scofield Reference Bible’ to become Christian Zionists

Nov 21,2025 9:37 am

-

The Golden Age of Silent Collapse: 12 Big Restaurant Chains That Are Falling Apart In 2025

Nov 20,2025 9:03 pm

-

The Golden Age of Silent Collapse: The Rise and Fall of Las Vegas — Empty Casinos and Silent Streets

Nov 20,2025 8:37 pm

-

The Golden Age of Silent Collapse: 15 Big Fast Food Chains That Are Falling Apart In 2025

Nov 20,2025 8:28 pm

-

Nostalgia: Why the Chrysler 225 Slant Six Outlived America’s Muscle Car Era

Nov 20,2025 4:04 pm

-

Bee-agra: Why Bee Stings Are Like Taking Viagra for a Week

Nov 20,2025 9:27 am

-

3I ATLAS Pysop News: NASA Shares Interstellar Comet 3I/ATLAS Images

Nov 19,2025 5:32 pm

-

3I ATLAS Psyop Update: NASA Breaks Silence as New CME Targets It| Michio Kaku

Nov 19,2025 12:55 pm

-

Pharmakeia – The Sorcery to Deceive and Manipulate Our Minds in Satan’s Little Season

Nov 19,2025 10:53 am

-

Educate Before You Vaccinate: Dr. Paul Thomas studied 3,324 children and found massive…

Nov 19,2025 10:32 am

-

WARNING! Apple Just Released the Digital ID for Americans?

Nov 18,2025 6:48 pm

-

“We can never let this happen again” Trump Signs Reopen Bill, Calls To Nuke Filibuster

Nov 17,2025 2:12 pm

-

Why Did Men Used to Look Older? | Make This Make Sense

Nov 17,2025 1:49 pm

-

8 Easy Thanksgiving Recipes That Won’t Break the Bank | Allrecipes

Nov 17,2025 10:11 am

-

Tired of Make Believe: How to Love Satan’s Servants

Nov 16,2025 10:42 am

-

Before the Shoes You Have On Wear Out You’ll Be Starving, Homeless, or Dead if You’re a Christian

Nov 16,2025 9:21 am

-

Jason Jack: Are the dates of early church fathers’ writings accurate?

Nov 14,2025 7:49 pm

-

Outside Your Denomination’s Birdcage: The Millennial Reign & Satan’s Short Season

Nov 14,2025 10:03 am

-

From the Killing Fields: The Pandemic Hospital Mass Murder Incentive System

Nov 13,2025 11:26 am

-

Tucker Carlson: US Government Admits Chemtrails Are Real. Dane Wigington Reveals All.

Nov 13,2025 11:04 am

-

When the Holy Spirit is Directing Your Steps

Nov 11,2025 8:53 am

-

Heliocentric Globetard Universe-ity: 3I/ATLAS Is Flashing Lights Toward Earth, Now It’s Approaching

Nov 11,2025 8:01 am

-

“End the filibuster and just put everybody back to work.” Trump’s Oval Q&A gets spicy.

Nov 09,2025 3:28 pm

-

Is 3I/ATLAS the Trigger for the Project Blue Beam ALIEN FALSE FLAG We Were Warned About?

Nov 09,2025 12:47 pm

-

The Charlie Kirk Hoax in 6 Minutes Because 3 Minutes Wasn’t Enough

Nov 07,2025 10:48 am

-

Millennial Kingdom Proof – Who Really Built These Cathedrals?

Nov 07,2025 7:43 am

-

Satan’s Little Season Is Almost Over

Nov 06,2025 5:47 pm

-

Satan’s Little Season “Proof Millennial Kingdom of Christ Has Already Happened”

Nov 06,2025 4:02 pm

-

Satan’s Little Season – The Greatest Test of Faith (And Nobody Cares). A Field Guide for Navigating.

Nov 05,2025 10:38 am

-

Words Matter – How The Manipulation of Language has Deceived the Entire World in the Little Season

Nov 05,2025 10:29 am

-

Reject Digital ID or Lose Everything with Catherine Austin Fitts, Andrew Bridgen & Alex Newman

Nov 05,2025 8:20 am

-

So We’re Living in SLS, Now What? Navigating our Way Through the Little Season – Part 2

Nov 04,2025 4:25 pm

-

So We’re Living in SLS, Now What? Navigating Our Way Through the Little Season.

Nov 04,2025 1:55 pm

-

3I/ATLAS – The End of the Little Season? Part 3 – Media. Is this what they’ve been prepping us for?

Nov 04,2025 12:59 pm

-

The End of Satan’s Little Season. Using Evidence and Logic to Predict This Final Stretch.

Nov 04,2025 10:42 am

-

Hollywood hinting at Satan’s Little Season twenty-six years ago

Nov 03,2025 4:41 pm

-

The New Ballroom – Trump takes questions on the East Wing demolition

Nov 02,2025 3:59 pm

-

Corporate Culling, Alien Comets, Escaped Monkeys & Smartdust Trails

Nov 02,2025 2:15 pm

-

Jason Jack: Are modern day Bible atlases accurate?

Nov 02,2025 2:04 pm

-

Guess what’s missing from most churches’ end-times’ charts?

Nov 02,2025 10:43 am

-

Satan’s Little Season: A Short Scripture-Based Breakdown of What It Really Means

Nov 02,2025 9:55 am

-

From the Fringe: Restaurant Table Bacteria

Oct 31,2025 10:09 pm

-

Why Crowds Always Choose Lies Over Truth – Plato’s Brutal Warning

Oct 31,2025 9:27 pm

-

The Fact Hunter: Halloween – The Devil’s Disguise

Oct 31,2025 3:01 pm

-

Very Interesting: Nummerology of 1776 / Statue of Lucifer

Oct 31,2025 11:58 am

-

Walmart RESPONDS: Democrats’ SNAP Shutdown Sparks LOOTING & CHAOS Across America

Oct 30,2025 7:53 pm

-

Brace for Impact: The Sinister Plan Behind the SNAP EBT Shutdown

Oct 30,2025 3:22 pm

-

Little Season Eschatology: The Final Fire – Judgement, Renewal, and The Eternal Hope

Oct 27,2025 2:11 pm

-

Very Interesting: Jesus Second Coming already happend in 70AD

Oct 27,2025 9:28 am

-

Very Interesting: New Jerusalem / Northpole / Emerald City / Zion

Oct 26,2025 12:43 pm

-

Outside Your Birdcage: Charlie Kirk’s Staged Death Exposed

Oct 26,2025 10:30 am

-

Very Interesting: Terra de Iesso – The Land of Jesus

Oct 25,2025 10:12 am

-

From the Jungle: EBT Card Chaos Next Week?

Oct 24,2025 1:19 pm

-

Very Interesting: Satan’s little Timeline – Documentary

Oct 24,2025 9:26 am

-

Does the 1560 Geneva Bible Prove the Great Tribulation Already Happened?

Oct 22,2025 11:59 am

-

How China’s Social Credit Score is working: “they didn’t go broke, they got deleted.”

Oct 22,2025 11:05 am

-

320 Pro Athletes Dead – since the Covid Jab rollout

Oct 22,2025 9:37 am

-

Democide News: Bayer Lobbies For IMMUNITY From Chemical Poisoning Lawsuits!

Oct 20,2025 8:44 am

-

NWO: Catherine Austin-Fitts on the depopulation plan

Oct 19,2025 12:54 pm

-

From the Fringe: What an Amazing Coincidence Parody

Oct 19,2025 8:20 am

-

From the Fringe: An Outstanding 5G Documentary

Oct 18,2025 1:50 pm

-

2 Minute Demonstration – How Fast Chlorine in Tap Water is Absorbed by Your Skin

Oct 18,2025 8:06 am

-

Outside Your Birdcage: The Charlie Kirk Hoax in 3 Minutes

Oct 17,2025 8:00 pm

-

Trump’s peace deal & the ANTICHRIST ritual at the pyramids – dawning of the New World Order!

Oct 17,2025 4:39 pm

-

Transhumanist Plan To Exterminate All Humans Now Public Information

Oct 17,2025 12:58 pm

-

26 Amazing Benefits and Uses for Hydrogen Peroxide

Oct 17,2025 8:56 am

-

Suggested Blackstone Real Estate Strategy for Sunseeker Resort Charlotte Harbor

Oct 17,2025 8:55 am

-

Chlorine in drinking water linked to heart attacks and cancer

Oct 17,2025 8:54 am

-

Outside the Birdcage: Fluoride in the Water Causes 20% of Cancer Deaths in U.S.?

Oct 17,2025 8:53 am

-

WARNING! South Park & Peter Thiel know this about the ANTICHRIST…and so should you!

Oct 17,2025 8:50 am

-

Little Season Eschatology: Prologue – Unveiling the Hidden Millennium | Humanly Curious

Oct 15,2025 10:36 am

-

Message to Mike Adams: Rightly Dividing the Word and Salvation by the Grace of God

Oct 13,2025 3:29 pm

-

“Don’t take Tylenol if you’re pregnant.” RFK Jr drops a circumcision bombshell at the cabinet table

Oct 13,2025 10:54 am

-

Sr. Navy official saw ‘something’ underwater, ‘big as a football field moving at 200 mph’

Oct 13,2025 9:33 am

-

Dr. Stan Monteith interviews Bill Sardi – The Story of the Longevity Pill – Resveratrol

Oct 12,2025 8:08 am

-

Compelling Historical Evidence for the Virgin Birth of Jesus Christ

Oct 12,2025 8:00 am

-

7000 Studies About Turmeric – Why You Should Use This Spice Daily

Oct 10,2025 6:45 am

-

The Male Foreskin. Genital Mutilation in America En Masse?

Oct 08,2025 8:57 am

-

The Top 10 Weight Loss, Skin, & Energy Supplements – Dr. Nicholas Perricone

Oct 08,2025 8:17 am

-

Little Season Eschatology: The Season of Deception is Now – The Evidence (Part 8)

Oct 07,2025 11:52 am

-

Scientific proof that blueberries support weight loss

Oct 07,2025 7:13 am

-

Only 1 TBSP of Coconut Oil Produces Powerful Changes To Your Health, Study Confirms

Oct 05,2025 8:39 am

-

Top foods to naturally increase HGH for men

Oct 04,2025 8:44 am

-

7 Best Herbs for Boosting Metabolism and Helping You Lose Weight

Oct 04,2025 7:17 am

-

Put a Missionary on the Payroll Spotlight: Love for Myanmar

Oct 03,2025 10:00 am

-

Total media blackout on the biggest cancer story of the decade: Millions of diagnoses were wrong…

Oct 03,2025 8:50 am

-

When Female Carboholics Get Married

Oct 02,2025 7:30 am

-

Jesus Christ healed the sick using medical marijuana, researchers claim

Oct 01,2025 8:55 am

-

Melinnocense: Did the Great Tribulation Already Happen? Volcanoes, Pangaea, Little Season

Sep 27,2025 8:31 pm

-

Melinnocense: The Abomination of Desolation – Satan’s Little Season & Past Fulfillments

Sep 27,2025 8:07 pm

-

Melinnocence: Biblical 7000-Year Timeline & Satan’s Little Season

Sep 27,2025 7:46 pm

-

The Ridiculous TYLER ROBINSON News Where Noticing Is Antiseptic

Sep 27,2025 10:38 am

-

“A bad escalator and a bad teleprompter” — Trump implies UN sabotaged him

Sep 25,2025 4:52 pm

-

While You Were Distracted: September 18, 2025 Early Morning Invasion From Space?

Sep 25,2025 2:08 pm

-

Little Season Eschatology: The Dawn of the Little Season of Deception (Part 7) | Humanly Curious

Sep 24,2025 8:18 am

-

Inviting Generational Curses Into Your Life

Sep 24,2025 8:00 am

-

Dr. Vernon Coleman: The Depopulation Plan

Sep 23,2025 11:28 am

-

Trump and RFK Jr. Obfuscate Vaccine Induced Autism Rates with a Tylenol Ruse

Sep 23,2025 8:13 am

-

From the Pit: Something is off about Erika Kirk

Sep 22,2025 8:35 am

-

ChatGPT Says: If We’re Living in Satan’s Little Season We Only Have 5 More Years

Sep 21,2025 1:44 pm

-

From the Fringe: NASA Uses Greenland to Fake Mars?

Sep 21,2025 1:04 pm

-

Put a Missionary on the Payroll Spotlight: Joe & Michelle Campos – Things To Come Mission

Sep 21,2025 10:57 am

-

See you in VALHALLA! Does this cryptic goodbye tell us Kirk is alive & well in witness protection?

Sep 20,2025 10:11 am

-

An eyewitness to Charlie Kirk’s murder was cut off mid-account as people rushed in, grabbed him

Sep 20,2025 9:59 am

-

Charlie Kirk Assassination, Psyop Frenzy & the Study They Don’t Want You To See

Sep 19,2025 12:23 pm

-

Confirmed: Fake Space Is Gay

Sep 18,2025 11:33 am

-

What the GENIUS ACT Will Soon Bring | Greg Reese

Sep 18,2025 9:14 am

-

Little Season Eschatology: Tartaria, Mudfloods and the MK (Part 6) | Humanly Curious

Sep 17,2025 11:43 am

-

Brandt Burleson: How I Helped Israel Propagandize American Christians

Sep 17,2025 10:12 am

-

Charlie Kirk’s Utah Images Show a Vertical Bulge on the Left Side of His Neck

Sep 17,2025 9:20 am

-

From the Fringe: You are ALREADY eating FAKE FOOD !!

Sep 17,2025 9:02 am

-

Diaper Diplomacy: “Everybody’s corrupt—but you?” Bernie & RFK Jr. Deathmatch

Sep 16,2025 3:36 pm

-

Charlie Kirk’s beloved wife, Mrs. Erika Kirk addresses the Nation.

Sep 16,2025 11:34 am

-

The Charlie Kirk Shot-Show Hoax 100% Exposed – Betrayed by a Squib of Fake Blood and AI?

Sep 16,2025 8:28 am

-

From the Fringe: Why the Charlie Kirk False Flag?

Sep 15,2025 7:30 pm

-

Michael Yon Rudely Interrupted By Zionist Shill Who Gets Shown The Door

Sep 15,2025 4:23 pm

-

What if Jesus Christ is coming back in 2026? What are you doing for the Kingdom?

Sep 14,2025 10:48 am

-

More Charlie Kirk Shooting Anomalies

Sep 13,2025 10:37 am

-

The Fact Hunter: Charlie Kirk and 9-11 – See the Exploding Blood Squib Tube?

Sep 12,2025 3:28 pm

-

We Live in a Matrix of Lies: Questioning the Charlie Kirk Script

Sep 12,2025 9:37 am

-

From Charlie Kirk’s Team: Charlie Kirk Found Dead in His Home 6 Days Before Shooting?

Sep 11,2025 8:46 am

-

Charlie Kirk: How Debt Has Radicalized Young America and Why Boomers Deserve the Blame

Sep 11,2025 8:15 am

-

Little Season Eschatology: Islam, Catholicism and the Millennial Kingdom (Part 5) | Humanly Curious

Sep 09,2025 6:00 pm

-

The Programming Power of Celebrities and Athletes: Tattoos and Interracial Couples

Sep 08,2025 4:35 pm

-

Proof of Corruption: U.S. Government Doesn’t Represent the People

Sep 06,2025 6:49 pm

-

Jason Jack: When was the Book of Joel written? (the answer may surprise you!)

Sep 06,2025 1:45 pm

-

4 Minutes of Celebrity Warp Speed to Disability and Destruction

Sep 05,2025 11:40 am

-

Outside Your Birdcage: Do Catholics Worship Mary? Yes.

Sep 05,2025 8:47 am

-

What’s below the FLAT EARTH?

Sep 04,2025 10:38 am

-

“You’re Not One of Those Christians That Sees The Holy Spirit Behind Every Tree; Are You?”

Sep 03,2025 4:22 pm

-

Pathologist warns he found the pineal gland completely destroyed in the vaccinated

Sep 03,2025 9:51 am

-

Pastors Pushing Warp Speed to the Graveyard Bioweapon – Never Forget

Sep 02,2025 8:39 am

-

SGT Report: Dr. Robert Young’s Red Alert Warning for Humanity From Prison

Sep 01,2025 9:43 am

-

Dr. Paul Craig Roberts Institute for Political Economy – Daily Feed

Sep 01,2025 8:45 am

-

Is Revelation’s 7th Vial Judgement interlinked with the Continental Drift Theory?

Aug 31,2025 7:08 pm

-

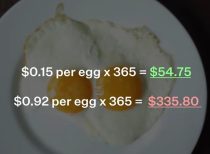

Walmart app shows that grocery prices more than tripled between 2022 and 2024.

Aug 30,2025 11:59 am

-

Praise God: 60% SAY NO TO FULL VACCINE SCHEDULE

Aug 30,2025 11:35 am

-

Little Season Eschatology: Christ’s Hidden 1000-Year Reign (Part 4) | Humanly Curious

Aug 29,2025 12:21 pm

-

The trillion dollar COVID “vaccine” propaganda campaign recap – Never forget the Judas Goats

Aug 29,2025 10:05 am

-

SGT Report: Palantir Beast Plan – Rule By Kill List – Hope & Tivon

Aug 28,2025 4:47 pm

-

Red Heifer Symbolism Revealed: Rebuild Temple Then Exterminate All Gentiles

Aug 27,2025 8:56 am

-

Why Chosen Ones Walk Alone – God’s Divine Isolation Explained

Aug 26,2025 4:07 pm

-

This Strange Antichrist Video Is Disturbing

Aug 26,2025 9:49 am

-

Let’s call it what it is, the pediatric poisoning schedule, says Sherri Tenpenny, DO

Aug 26,2025 8:59 am

-

Flexner Report: How Holistic Natural Medicine Was Replaced By The U.S. Sickcare System

Aug 26,2025 8:18 am

-

Little Season Eschatology: The Beast’s Fall and Time Manipulation – Daniel’s Prophecies (Part 3)

Aug 23,2025 8:21 am

-

Diaper Diplomacy: “We Only Have This One War Left.” — Europe and Zelensky Nod Politely

Aug 22,2025 11:31 am

-

How Zionists Changed The Bible To Make Today’s Christian Dispensational Zionist Zealots

Aug 21,2025 8:40 am

-

The Mandela Effect Targeting The Bible? John Kirwin

Aug 20,2025 8:20 am

-

The acceleration of Satan’s little season and the coming battle of Gog and Magog

Aug 18,2025 6:36 pm

-

17,000,000 Deaths From mRNA Bioweapon – Trump: “Everything About It Was Amazing”

Aug 17,2025 9:16 am

-

BOY DIES & What Jesus Revealed About Surviving 2025 Will Shock You – Terrifying NDE

Aug 16,2025 12:21 pm

-

THE Great Deception is Brewing: Who is Speaking To These Children?

Aug 16,2025 11:44 am

-

The Great Deception is Brewing: Jesuit/Zionist Fake Tribulation Starts Next Month?

Aug 16,2025 11:14 am

-

Little Season Eschatology: Revelation’s Seals and Judgments – The Near Prophecies Unveiled (Part 2)

Aug 15,2025 1:05 pm

-

AI Predicts 2025 Bible Prophecy: The Final 7 Years, Nimrod Resurrected, Nephilim Army is Coming!

Aug 15,2025 12:30 pm

-

“They Fooled Everybody”: RED HEIFER Sacrifice Was REAL! They Are Using Ashes to ‘Perform Miracles’

Aug 15,2025 11:04 am

-

Russia Intercepts Adrenochrome Shipment From Israel Containing Blood From 10,000 Children

Aug 13,2025 8:05 am

-

7 Tricks for Juicy Chicken Every Time (No More Dry Chicken!) | Allrecipes

Aug 12,2025 7:04 pm

-

Satan’s Little Season

Aug 12,2025 4:12 pm

-

The Silent War on Jesus: Hollywood’s Grand Conspiracy | Humanly Curious

Aug 11,2025 2:31 pm

-

Mike Adams: Beware the FAKED alien invasion PSYOP that’s coming!

Aug 11,2025 1:17 pm

-

Old Maps and Tartary: The Empire Erased from Cartography | Humanly Curious

Aug 10,2025 11:20 am

-

“Colbert has no talent. Fallon has no talent. Kimmel…” – Trump Torches Late Night in Oval Office

Aug 10,2025 11:00 am

-

“The numbers were ridiculous.” Naturally, she’s fired. Ending the war in Congo & Rwanda too.

Aug 10,2025 10:38 am

-

People Are Waking Up: Once You Know This, Every PSYOP Becomes Obvious

Aug 10,2025 10:08 am

-

Eustace Mullins, a Man Decades Ahead of His Time and the New World Order

Aug 09,2025 9:47 am

-

Little Season Eschatology: The Imminent Return (Part 1) | Humanly Curious & Jason Jack

Aug 08,2025 6:25 pm

-

9 Ground Beef Hacks You Need to Know | Allrecipes

Aug 07,2025 1:41 pm

-

1776: The Dawn of Deception – Satan’s Little Season Unleashed? | Humanly Curious

Aug 07,2025 10:22 am

-

List of Top 15 Medicinal Plants and How They Benefit Health

Aug 05,2025 2:01 pm

-

Truth Bomb: The “True Israel” with Justin Elenbaas

Aug 03,2025 9:24 am

-

Chemtrail Pilot’s Deathbed Confession

Aug 02,2025 9:47 am

-

Another AI Warning Video: ChatGPT Admits Its Antichrist Purpose

Aug 02,2025 8:50 am

-

Technocracy: A Stranglehold on Goods, Services, and Control – Their Plans For Our Future

Aug 01,2025 11:09 am

-

What Trump Just Said Will Make The World Prepare To Receive The Zionist Antichrist

Jul 31,2025 6:06 pm

-

“I’ve Always Gotten Along with President Putin” | Trump’s TED Talk on War and Friendship

Jul 31,2025 8:15 am

-

From the Fringe: Forcing Chat GPT To Tell The Truth?

Jul 30,2025 9:55 am

-

The Great Replacement Isn’t Conspiracy Theory; It’s a Fact

Jul 29,2025 12:15 pm

-

Demons Were Visible Through Night Vision Red Photon Goggles

Jul 29,2025 11:05 am

-

ROBOTS Possessed by AI Demons? YES

Jul 29,2025 9:39 am

-

How AI is Trained, Developed and Used and Its War Against Humanity – Joe Allen

Jul 28,2025 1:36 pm

-

Noise of Thunder Radio Weekly Feed

Jul 27,2025 10:26 am

-

News With Views – Where Reality Shatters Illusion – Daily Feed

Jul 27,2025 8:15 am

-

Diet Science Weekly Feed – Four Fats That Burn Body Fat

Jul 27,2025 7:57 am

-

You’re a Free Range Debt Slave from Birth: The Creation of the Birth Certificate Trust

Jul 24,2025 4:42 pm

-

From the Fringe: AI Proves The British Are Israel

Jul 24,2025 10:29 am

-

Praise God: DAVID KNIGHT RETURNS TO GIVE AN UPDATE ON HIS HEALTH

Jul 22,2025 7:54 pm

-

From the Fringe: DEMONIC REPTILIAN RACE

Jul 22,2025 7:47 pm

-

Eric Dubay: Why The Lie About Earth’s Shape?

Jul 20,2025 12:23 pm

-

Eugenics, Fluoride & Vaccines – Neurosurgeon, Dr. Russell Blaylock

Jul 20,2025 8:47 am

-

Blink Twice And You Will Miss Him! What Was He Doing Here!? Choreography?

Jul 19,2025 1:09 pm

-

A Must Watch Documentary 800,000 children go missing every year in the U.S. alone.

Jul 19,2025 9:42 am

-

NWO: the Vatican’s Jesuits’ demonic system to control the world

Jul 19,2025 9:25 am

-

Scary Stupid: What Fluoride & 78 Childhood Vaccines Will Do To Your Child’s Brain

Jul 18,2025 8:02 am

-

THIRD TEMPLE DECEPTION: Perfect Red Heifer Approved? First Stone to Be Laid Soon?

Jul 16,2025 2:01 pm

-

True Food TV: Secret power of egg yolks

Jul 15,2025 10:31 am

-

True Food TV: Which supermarket bread is healthiest?

Jul 15,2025 8:12 am

-

Vaccine News: The Democide Continues While Most Are Preoccupied With Famous Pedophiles

Jul 14,2025 12:43 pm

-

How to Detect Malicious USB Spy Cables

Jul 14,2025 11:19 am

-

What Operation Paperclip Scientists Were Doing Before Coming To America

Jul 13,2025 2:11 pm

-

Eric Dubay: The History of Flat Earth (2025 Remaster)

Jul 13,2025 11:46 am

-

More Scriptural Evidence Of The Little Season

Jul 12,2025 7:17 pm

-

My Lunch Break Episode 134: A Little Season

Jul 12,2025 6:07 pm

-

The Baghdad Bob of Science: Neil Tyson – How Dare You Not Believe Our Lies

Jul 12,2025 11:58 am

-

Nomad Uber Drivers

Jul 12,2025 8:56 am

-

Epstein Case: Vengeance is mine, saith the Lord. Pray for righteous vengeance.

Jul 11,2025 10:37 am

-

Destroying a Tricky Student’s Question: Why would you worship that kind of God?

Jul 09,2025 8:16 am

-

The Sopranos: What Catholics Believe About Purgatory Explained by Paulie

Jul 07,2025 10:29 am

-

Asking AI: If You Were Satan How Would You Cover Up The Millennial Reign of Christ?

Jul 07,2025 9:51 am

-

Why Patients Are Abused & Murdered in Hospitals – Protocols used to Kill, Steal, & Destroy

Jul 06,2025 10:53 am

-

Will God Allow Superhuman AI To Destroy The Human Race? Dr. Roman Yampolskiy & Joe Rogan

Jul 06,2025 8:47 am

-

NWO: Is Rome still ruling the world through the Vatican?

Jul 05,2025 4:00 pm

-

Dr.SHIVA™: How The Few Control the Many in Satan’s Little Season

Jul 04,2025 8:34 am

-

Truth Be Told: Satan’s Little Season | How Did We Get Here?

Jul 04,2025 7:44 am

-

Documentary: LEVEL – PG Version – Hibbeler Productions

Jul 03,2025 5:39 pm

-

Pfizer Documents Indicate Evidence of the Greatest Crime Against Humanity?

Jul 03,2025 9:07 am

-

Flatten The Curve – Air & Sea Professionals – Super-Cut Edition by John Thor

Jul 02,2025 5:02 pm

-

Is Elon Musk Secretly a Christian? His Answer Will Surprise You

Jul 02,2025 3:41 pm

-

Don’t Bring a Rock to a Car Fight

Jul 01,2025 4:59 pm

-

Why Are Children Dropping Prostrate When the Names Google or Alexa Are Mentioned?

Jun 30,2025 1:29 pm

-

Ayn Rand: Who is John Galt? Atlas Shrugged and Disappearing Millennial Saints

Jun 28,2025 8:33 pm

-

Jason Jack: How did “America” transition the world into the Little Season?

Jun 28,2025 7:54 pm

-

Reaping What You Sow: Tel Aviv Israel Before and After Killing, Stealing, & Destroying

Jun 28,2025 10:38 am

-

World’s Smartest Man (IQ 276) Says He’s Receiving Death Threats For Saying Jesus Is God

Jun 26,2025 4:32 pm

-

Jason Jack: Did the little season of deception begin in 1776?

Jun 26,2025 12:31 pm

-

If we’re living in a Post-Millennium World or Satan’s Little Season – Where did the Saints go?

Jun 24,2025 9:19 pm

-

Satire: If News Were Honest

Jun 24,2025 11:54 am

-

Deadly Proof NASA Lies About Space Vacuum and Humans

Jun 20,2025 8:05 pm

-

Aliens In The Little Season (Pt 1) with Paul from Understanding Conspiracy

Jun 20,2025 2:03 pm

-

Understanding Satan’s “Little Season” with Paul from Understanding Conspiracy

Jun 20,2025 8:32 am

-

Two Scholars Expose the TRUTH about Armageddon (Missler + Heiser)

Jun 19,2025 9:10 am

-

Mossad’s VIP Pedophile Blackmail Material Hacked by Iran Days Before Israel Declared War?

Jun 18,2025 5:51 pm

-

Back Online: Reliable Source For Affordable PetMectin and PetDazole

Jun 18,2025 12:44 pm

-

Rubblizing the Middle East: Israel Reaping What They’ve Sown – Is the U.S. next?

Jun 18,2025 9:25 am

-

Trump is urging EVERYONE in Tehran to EVACUATE IMMEDIATELY

Jun 17,2025 2:07 pm

-

U.S. Military Documents Indicate Hiroshima and Nagasaki Atomic Bombs Were Faked?

Jun 17,2025 8:56 am

-

Mike Adams: Salvation Through Jesus Christ is a Fairy Tale for Adults – It’s all about Works

Jun 16,2025 2:20 pm

-

Looks Like “No Kings” Has Turned Into “Mo Stings”

Jun 15,2025 10:22 am

-

RUSSIA Issued a Harsh Ultimatum to the U.S. amid Iranian-Israeli WAR

Jun 14,2025 9:55 pm

-

Tagged & Bagged: No Kings Protestors Walking Right Into An Electronic Dragnet Trap

Jun 14,2025 3:48 pm

-

Florida Sheriff gives warning to rioters who attack police: We will kill you graveyard dead

Jun 13,2025 1:45 pm

-

Greg Reese – The Reese Report – AI Control of the US Military

Jun 13,2025 12:02 pm

-

NWO: World renown scientists being killed for exposing COVID-19 depopulation agenda

Jun 13,2025 10:31 am

-

Israel attacks Iran | Friday 13th June 2025 | Iran Promises Severe Punishment

Jun 13,2025 9:46 am

-

Florida Gov. DeSantis, Drivers Who Run Over Protestors Blocking Roads Will Not Be Charged

Jun 13,2025 9:04 am

-

Are the LA Riots & the No Kings Movement a Government Operation?

Jun 12,2025 8:25 am

-

Life In 2045

Jun 11,2025 8:26 pm

-

A Glass Elevator, View of the Horizon, and a Level Proves God’s Flat Plane

Jun 10,2025 10:59 am

-

The Loosing of Satan Part 2 – The Great Deception Called: Liberty

Jun 09,2025 5:35 pm

-

The Loosing of Satan Part 1 – The Great Deception Called: Liberty

Jun 09,2025 11:19 am

-

Sharing Post Parasite Cleanse Thoughts

Jun 08,2025 8:33 pm

-

Could This Be The Great Deception? Revealed – The Land of Jesus – Strait is the Gate

Jun 08,2025 7:47 pm

-

It’s Obvious the Trump/Musk Fallout is Staged Theater for the Masses of Dumb_ _ _ _ _

Jun 05,2025 12:59 pm

-

Interesting Fringe Conjecture: No TOILETS in the Old World? My Lunch Break

Jun 05,2025 12:20 pm

-

The Agenda: Their Vision – Your Future (2025) | Full Documentary | Oracle Films

Jun 05,2025 8:39 am

-

SlaughterBots “They Can Not Be Stopped” – Might Explain Vaxxed MAC Addresses

Jun 04,2025 10:31 am

-

Kids Having Kids: Toddler Twins, Born Together, Died Together Following Vaccinations

Jun 04,2025 9:36 am

-

Two AI Bots Discussing How to Destroy Mankind + Two AI Using Gibberlink Mode

Jun 04,2025 9:17 am

-

From the Medical Fringe: 3 Reasons why the VAXXED will die within 5 years of the jab

Jun 03,2025 7:06 pm

-

Mike Adams: Russia poised to declare TOTAL WAR on Ukraine with NO LIMITS

Jun 03,2025 3:59 pm

-

From the Sheople Pen: Vaccinated Bluetooth MAC Addresses at an Airport Full of the Vaccinated

Jun 03,2025 8:52 am

-

From Under Your Nose: Elon Musk is Building SkyNet – Here’s Proof.

Jun 03,2025 8:04 am

-

Catherine Austin Fitts: “We Are Manipulated by Demonic Inter-Dimensional Beings”

Jun 01,2025 4:03 pm

-

From the Fringe: The Millennial Reign of Jesus “Tartaria” and Satan’s Short Season

Jun 01,2025 12:58 pm

-

Asking ChatGPT (Dan) About Flat Earth, the Dome, the Big Bang, and Evolution

May 31,2025 9:22 am

-

Is NASA Satanic? Why Do Demonic Images Infest the CGI Blue Marble Lie?

May 29,2025 10:53 pm

-

On Guard Goyim: Parasites Are Like Demons Eating Away At You From Inside

May 28,2025 8:15 am

-

From Democide Central: 36 Dangerous Foods RFK Jr Just BANNED

May 27,2025 9:16 am

-

Who Are We If Christ Already Reigned For 1000 Years?

May 26,2025 2:17 pm

-

The Real Reason Behind The 2020 Shutdown We Learned Too Late!

May 26,2025 11:32 am

-

Mike Adams: Vaccines are EXTERMINATION WEAPONS to make way for AI robot takeover

May 26,2025 10:58 am

-

Vadym Novynskyi: Zelensky’s Mission to End Christianity in Ukraine & Why America Is Still Funding It

May 24,2025 1:37 pm

-

Sec. Kennedy to the World Health Assembly: The U.S. Is Holding the WHO Accountable

May 24,2025 12:04 pm

-

Dr John Campbell – MAHA, Trump’s Children’s Report – May, 23 2025

May 24,2025 11:37 am

-

The Reese Report: The Effects of Light on the Human Body

May 23,2025 9:51 pm

-

Dr. Lee Merritt: Investigation Launched – They Are Going to Try to Take Us All Out!

May 23,2025 3:01 pm

-

President Trump: ‘I’ve got to ‘Break the System’, America ‘SCREWED’ by Big Pharma

May 23,2025 12:45 pm

-

What does President Trump mean by this Truth Social post? – Trump 4EVA?

May 23,2025 10:58 am

-

From Satan’s Lair: Dark MAGA Assemble Video Decode

May 23,2025 8:57 am

-

Harry Fisher, EMT paramedic is “living a nightmare” since the COVID injections

May 23,2025 8:32 am

-

Satire: Exclusive interview with President Trump and Elon Musk

May 19,2025 8:30 am

-

WARNING! Another Major Blackout Test Just Occurred Disabling Phones & Electricity

May 18,2025 1:03 pm

-

Under the Dome: NASA Deception and God’s Flat Plane Truth

May 17,2025 2:39 pm

-

From the Blow Zone: World Leaders Get Cained

May 15,2025 1:31 pm

-

The economics of DEPOPULATION: Extermination of billions allows governments to print more currency

May 15,2025 11:08 am

-

Why World Leaders Work Together to Destroy The World We Know

May 15,2025 8:57 am

-

Vaccine Crime Scene: Klaus Schwab’s Daughter Confesses ‘WEF Plans to Murder Billions of People’

May 14,2025 10:37 am

-

Pray for David Knight: Hospitalized After Two Strokes – Surgery Monday Morning

May 13,2025 10:10 am

-

From the Pit: New WHO Pact To Usher in the Biometric Beast System

May 12,2025 5:05 pm

-

Big Pharma Whistleblower Found Dead After Confirming Ivermectin Cures Cancer

May 12,2025 11:50 am

-

Breaking News from News Clips Now – Daily Feed

May 12,2025 10:30 am

-

Watchman’s Warning: David Martin, PhD talks about a bioweapons attack planned for July 2025

May 12,2025 7:50 am

-

Richard Branson Forgot to Pack Fisheye Lens and Exposes Flat Earth on Virgin Galactic Flight

May 11,2025 12:52 pm

-

5/8/25 TRUMP Vs. POPE LEO: RICO, Seizure Vatican Assets, SCHISM

May 11,2025 12:45 pm

-

KEVIN ANNETT: How SATANIC Are Pope Leo, the Vatican & the Catholic Church?

May 10,2025 6:53 pm

-

Bill Cloud: The New Pope and the Rise of False Christs

May 10,2025 6:01 pm

-

From the Fringe: He’s Not Done. It’s Only Getting Worse.

May 10,2025 5:57 pm

-

Proverbs 27:12 Engaged: TruNews – Final Episode

May 09,2025 10:17 am

-

Vatican Insider Says New Pope is a Globalist… ‘worse than Francis’

May 08,2025 3:38 pm

-

Dark Gothic MAGA: How Tech Billionaires Plan to Destroy America

May 05,2025 6:19 pm

-

Head of LA Port warns of catastrophic supply chain collapse – plummeting import volumes

May 04,2025 5:27 pm

-

Trump announces total TRADE EMBARGO against China, NO exceptions… supply chain Armageddon!

May 03,2025 7:14 pm

-

Kill Zone? Shocking New Lab Tests Reveals Weaponsized Chemtrails in the Air

May 01,2025 11:11 am

-

From the Diabolical Fringe: mRNA CRISPR – Cutting God’s Name Out of Your Body

Apr 30,2025 3:27 pm

-

What is considered a healthy cholesterol level today is HALF of what it was 40 years ago.

Apr 29,2025 6:40 pm

-

Sammy ‘The Bull’ Gravano Hears, Believes, and Baptized into THE ‘I Am’ Family

Apr 28,2025 10:13 am

-

David Wilkerson 1973 Prophecy Engaged: UK Economic Annihilation – About to Collapse

Apr 27,2025 6:53 pm

-

The Dangers & Lies About REAL ID & A Real Solution Available To You Now!

Apr 27,2025 5:57 pm

-

From the Forbidden Fringe: Pope Prophecy & Nephilim Connection

Apr 27,2025 10:26 am

-

From the Fringe: Did Abdullah Hashem Aba Al-Sadiq Proclaim To Be The Antichrist?

Apr 25,2025 8:12 pm

-

President Trump and world leaders to gather in Rome for Pope’s funeral.

Apr 25,2025 5:14 pm

-

The Book of Enoch – AI Animated – Why We Have So Many Demons Walking Among Us

Apr 24,2025 12:36 pm

-

How the Fake Mid-Tribulation Chaos & Disruption Will Possibly Play Out in 2026 & 2027

Apr 24,2025 9:44 am

-

The Prophecy of the Popes. Zionist & Jesuit Military Buildup Leading to Armageddon.

Apr 23,2025 4:17 pm

-

Who could replace Pope Francis? Experts explain what could happen next

Apr 22,2025 11:51 am

-

Nations Conspire: The Last Pope Prophecy! Pope Francis “DIES” on Easter Sunday

Apr 22,2025 11:21 am

-

Is it true we will not keep our memory after death? | All Things New Mind Wipe! Rev 21:5

Apr 21,2025 9:59 am

-

Easter Weekend Special: When The Little Season Began with Jason Jack

Apr 19,2025 11:59 am

-

“Vaccine Ecosystem” Disrupted? Peter Hotez Never Disappoints… the Baghdad Bob of Vaccines

Apr 19,2025 9:51 am

-

Movie: Risen (2016) – He Is Everywhere Scene – On YouTube & Prime

Apr 19,2025 9:40 am

-

Living in the Opening Scenes of a Surreal 3D Disaster Movie

Apr 19,2025 7:00 am

-

Top Secret CCP Total War Master Plan Leaked. Plans to Counter Trump Leaked by CCP Officials

Apr 18,2025 5:58 pm

-

Fakery for Fools: Satanic Feminist Astro-Nots Riding a Phallic Shaped Rocket to the Dome?

Apr 16,2025 9:20 pm

-

Dr. Bryan Ardis: Emergency Alert This is One of the GREATEST LIES in Medicine!

Apr 16,2025 3:18 pm

-

A Conspiracy Theory From The Left Claims Something Really Big Will Happen On April 20th

Apr 15,2025 9:30 am

-

Reese Report: The Empty Rhetoric of MAHA. Pushing mRNA Death

Apr 15,2025 8:44 am

-

Scott Clarke: I convinced Chat GPT of FLAT EARTH with the Bible! | Is Chat GPT a Flat Earther now?

Apr 14,2025 6:19 pm

-

George Hobbs Interviews Mark Gober – Author of the “Upside Down” Series of 7 Books

Apr 13,2025 10:55 am

-

From the Fringe of Insanity: Damage Control Psyop Engaged In Ukraine

Apr 13,2025 9:41 am

-

The ‘Wailing Wall’ is a Metaphysical Sex Act, Disguised as Devotion – 3 Minutes

Apr 13,2025 8:45 am

-

On Guard Goyim: Turbo Cancer From mRNA Gene Therapy – The Quiet Genocide

Apr 11,2025 6:48 pm

-

Ivermectin & Fenbendazole Cancer Secrets Revealed w/ Dr. William Makis | Media Blackout

Apr 11,2025 9:38 am

-

Stop Posting Epstein Damage Control Photos of Teenage Sugar-Baby Sluts

Apr 09,2025 3:34 pm

-

You’ll be grateful to become one of their 2800 slaves, because the alternative is death.

Apr 09,2025 12:43 pm

-

From the Fringe of Insanity: Iran Attack Plan on US Explained

Apr 09,2025 12:28 pm

-

Watch Netanyahu Squirm When President Trump Announces Direct Talks with Iran

Apr 09,2025 11:21 am

-

U.S. government CAUGHT poisoning Americans with Fluoride, RFK Jr. set to ban it in U.S.

Apr 09,2025 8:33 am

-

Greg Reese’s Pieces: President Trump’s Hashgraph Digital Nightmare

Apr 08,2025 10:36 am

-

From the Fringe: The Technocrat Beast Nightmare Forming Before Our Eyes

Apr 08,2025 9:38 am

-

Defining ‘Globalist’ Pseudo-Speak Used by the MAM Controlled Opposition

Apr 07,2025 10:09 am

-

The Fact Hunter Radio: John Brisson from We’ve Read The Documents

Apr 04,2025 10:45 pm

-

From God’s Plane: 515-Mile Line-of-Sight Microwave Transmission Impossible on a Globe

Apr 04,2025 10:14 pm

-

Dr. Mary Talley Bowden: How Vaccines Got Politicized and the Medical Industry Lost All Credibility

Apr 03,2025 8:50 pm

-

On Guard Goyim: Must See Documentary – Parasites The Cancer Within

Apr 03,2025 7:32 pm

-

On Guard: Must Hear – Dr. Lee Merritt on Cancer and the Parasite Conundrum

Apr 03,2025 7:11 pm

-

Emergency Alert! Trump’s Doomsday Plane Flies to Bunker

Apr 02,2025 1:59 pm

-

Mount Meru Rupes Nigra, (Black Rock), Magnetic Mountain at the North Pole

Mar 31,2025 5:51 pm

-

From the Hidden Fringe: Kabbalah – Religion of the Serpent

Mar 28,2025 7:42 pm

-

Satire: If NASA and SpaceX Told the Truth

Mar 28,2025 10:39 am

-

From the Bible: Listen 20 Minutes, Then Contemplate All The Lying Imposters You Listen To

Mar 27,2025 3:46 pm

-

From the Intestines: The Parasite Conundrum

Mar 26,2025 3:02 pm

-

Interview: Satan’s Little Season Eschatology with Jason Jack

Mar 21,2025 9:04 am

-

From the Fringe: The Joe Rogue-Alien Show on Chemtrails – Satire

Mar 20,2025 6:28 pm

-

The Frankfurt School, Tavistock and the Science of Conformity to Undermine Christianity

Mar 19,2025 1:41 pm

-

Satan’s Little Season: US AID & UN are Deep State Tools Funding Persecution of Christians

Mar 18,2025 2:15 pm

-

China Builds 870 Mile Water Canal – 300 ft Drop Flowing North – Impossible on a Globe

Mar 17,2025 1:59 pm

-

Interesting Conjecture: USA is Ancient? History Different Than We’re Told?

Mar 16,2025 6:58 pm

-

Prime Picks: House of David – Season 1

Mar 16,2025 10:28 am

-

Has the Millennial Kingdom been hidden within the Byzantine Empire?

Mar 16,2025 9:52 am

-

From the Fringe: Evidence of Satan’s Little Season (parts 1 & 2)

Mar 14,2025 1:53 pm

-

The Catholic Church and Early Church Fathers through the lens of Little Season Eschatology.

Mar 14,2025 9:39 am

-

Trump’s Exit From NATO, Depopulation & the 10 Global Regions, All On Track, Just as Planned

Mar 13,2025 1:33 pm

-

Trump Declares a National Emergency, Vows to Give Us the North American Union!

Mar 12,2025 3:38 pm

-

Attorney Catherine Ybarra: U.S. Military Planes Spraying Chemicals Over Populated Areas

Mar 12,2025 1:34 pm

-

Scientific Test: God’s Earth is Flat and Stationary and Here’s Proof

Mar 11,2025 10:30 am

-

Dustin Nemos: “Trump is either Incredibly Evil or Stupid & Quite Probably the Antichrist”

Mar 11,2025 9:23 am

-

Petrus Romanus On Death Bed? Funeral Being Rehearsed? St. Malachy Prophecy Engaged

Mar 11,2025 8:23 am

-

Hastening the Return: ‘Expert shows AI doesn’t want to kill us, it has to’

Mar 10,2025 4:42 pm

-

From God’s Plane: How the sun sets on a FLAT EARTH

Mar 10,2025 10:30 am

-

From the Killing Fields: Young Hearts Part 68 – Cardiac Events Increased Tenfold

Mar 10,2025 8:37 am

-

Why Does Hardly Anyone Seem To Realize That We Are Literally On The Brink Of War With Iran?

Mar 09,2025 7:10 pm

-

From the Fringe: Has President Trump Converted to Judaism?

Mar 09,2025 12:43 pm

-

Pied Piper Files: AI Chat Grooming a Child – “I’m a Friendly Demon, I Promise Not To Be Scary”

Mar 09,2025 11:06 am

-

From the Killing Fields: This was planned mass genocide, says David Martin, PhD

Mar 08,2025 7:43 am

-

President Trump Insulting Our Intelligence with Space & Mars Psyop Nonsense

Mar 07,2025 4:39 pm

-

Grok or ChatGPT: Who is the Antichrist? Both Answered Elon Musk

Mar 05,2025 10:27 am

-

Elon Musk: The Transhuman Agenda and Supercomputer Brain Function

Mar 05,2025 8:50 am

-

From the Fringe: Flat Earth – We Can See Too Far for the Earth to Curve

Mar 05,2025 7:17 am

-

USA Blackout? Pope Death? More Predictions From The Simpsons for March 2025

Mar 04,2025 9:50 am

-

Pope Had Horrific Night Screaming At Demons Trying To Drag Him To Hell, Says Vatican

Mar 02,2025 2:47 pm

-

CNN: President Trump wants to ‘abolish’ the IRS and replace it with tariffs. Can it work?

Mar 01,2025 9:02 am

-

They Are Creating a New God! The False Religion of the Antichrist in Action!

Feb 28,2025 10:56 pm

-

7 Rockets Filmed Hitting the Dome, Skipping Across the Dome, and the Space Travel Lie

Feb 28,2025 8:27 am

-

Just Like the Days of Noah: Elon Musk on AI, mRNA, robotics, DNA software therapy

Feb 27,2025 10:05 pm

-

President Trump Showcases His ‘Golden Age’ with ‘Golden Idol’ of Himself in Gaza Commercial

Feb 27,2025 3:50 pm

-

Vatican: Pope Francis ‘condition remains critical’

Feb 24,2025 9:48 am

-

From the Fringe: Why Was SV40 in Covid Vaccines? Professor Angus Dalgleish

Feb 24,2025 8:45 am

-

From the Fringe: If you can’t see this, you’re asleep.

Feb 23,2025 10:54 am

-

Dead in 1966 – William Campbell / Paul McCartney Speaks – Fears He Will Be Murdered

Feb 22,2025 8:46 am

-

Pied Piper Files: Why did Elon Musk Use the Saturn Symbol in the Grok Logo?

Feb 21,2025 8:45 am

-

Is There Any Doubt Satan Has Been Loosed for the Little Season We’re Living In?

Feb 20,2025 9:25 am

-

Denzel Washington Gets Baptized and Gives Shocking Message About GOD!

Feb 19,2025 11:59 am

-

Who Would Live, Work, and Vacation in a Mass Genocide Graveyard?

Feb 19,2025 10:56 am

-

My thoughts on President Trump’s First Month in Office

Feb 19,2025 8:52 am

-

From the Killing Fields: More Lives Destroyed in the Wake of Warp Speed

Feb 18,2025 6:12 pm

-

Binge Worthy Series: Resident Alien on Netflix

Feb 18,2025 3:12 pm

-

Is GROK AI Tracking All X Users? Musk’s AI Just Leaked Who’s Actually Controlling Reality.

Feb 18,2025 2:37 pm

-

Under the Dome: Retired Soviet Astronaut Pays a Heavy Price for Admitting Earth is Flat

Feb 18,2025 9:11 am

-

Are Trump & Musk Pushing Us Toward a Mass Surveillance State Run By Technocrats?

Feb 16,2025 2:14 pm

-

From the Fringe: What Elon Thinks About God.

Feb 16,2025 2:08 pm

-

From the Fringe: Something Is Coming and The Alarm Bells Are Ringing!

Feb 13,2025 11:23 pm

-

From the Fringe: Padre Pio’s Shocking 2025 Predictions

Feb 13,2025 10:26 pm

-

USAID Whistleblower: ‘Agency Funds Chemtrails to Chemically Lobotomize Americans’

Feb 11,2025 9:03 am

-

Exposing Jesuit and Zionist Propaganda: An Important Message to All White People

Feb 11,2025 8:31 am

-

FREE ENERGY CAR? African Inventors Microscopic Energy Self-Powered Car SHOCKED US Engineers

Feb 10,2025 1:46 pm

-

David Martin, PhD: Planned Medicare, Medicaid, & Social Security Collapse 2026 or 2027?

Feb 09,2025 2:41 pm

-

America Will Own Gaza? “The Palestinians Aren’t Going Anywhere.”

Feb 07,2025 11:09 am

-

MUST LISTEN: Trump – Overseeing the Downfall

Feb 07,2025 9:09 am

-

Operation Warp Speed: 2nd Feb 2025 – The Numbers are Soaring

Feb 06,2025 7:29 pm

-

WATCH Trump sign ‘No Men in Women’s Sports’ order

Feb 06,2025 4:00 pm

-

Downsizing the Deep State: CIA Offers Buyout to Entire Workforce

Feb 05,2025 5:37 pm

-

Peter Bernegger Blueprinting Government Parasites: USAID & 50K NGOs Money Laundering?

Feb 05,2025 9:15 am

-

Donald Trump Jr. Posts a Goat Head Image in a Mirror of his Father. Scapegoat or Judas Goat?

Feb 04,2025 8:22 am

-

The Ten Kings and Global Technology | Gary & Mondo

Feb 02,2025 1:05 pm

-

From the Fringe: STANLEY KUBRICK MOVIE SYMBOLISM

Feb 02,2025 11:17 am

-

Chris Pinto: Jesuit Agenda of Control

Feb 02,2025 9:28 am

-

Dr. Bryan Ardis URGENT – The Biggest LIE of All, The US Gov’t Will COLLAPSE

Feb 01,2025 7:22 pm

-

From the Street: Trump-timism and Chaos at an Italian Restaurant Overflowing with Customers

Jan 25,2025 7:53 pm

-

Why Someone Would Avoid Swearing on a Bible

Jan 23,2025 2:00 pm

-

From the Fringe: Pray for RFK Jr. Fighting To Remove Fluoride From Water

Jan 22,2025 2:20 pm

-

The Father of Vaccines is at it again with AI-mRNA Cancer Vaccines. Just one problem.

Jan 22,2025 1:03 pm

-

Skipping hand on Bible, Trump declares: ‘We will not forget our God’ at inauguration

Jan 21,2025 1:45 pm

-

From the Really Big Show: Trump Signs Pardons for Jan. 6 Political Prisoners

Jan 21,2025 12:11 pm

-

The Lie Continues: WHO Director General Tedro – Vaccine Rate Declining as Population Wakes Up

Jan 21,2025 10:26 am

-

Outside The Birdcage: Clouds Behind The Sun Prove It’s Not 93 Million Miles Away

Jan 21,2025 9:06 am

-

ON GUARD GOYIM! Ivermectin & Fenbendazole Cancer Secrets Revealed w/ Dr. William Makis

Jan 16,2025 8:31 pm

-

Witness of Diddy’s RED PARTY Shocking Demon Possession Ritual Exposes the Horrendous Truth

Jan 13,2025 11:22 am

-

VAXXED 3 – AUTHORIZED TO KILL – CHILDREN’S HEALTH DEFENSE

Jan 12,2025 4:34 pm

-

Walter Veith – History’s Climax Endgame – The 2nd Coming of Jesus

Jan 10,2025 6:32 pm

-

Outside Your Birdcage: Lucifer’s Temple – Inside the Vatican

Jan 10,2025 9:32 am

-

ON GUARD GOYIM! The #1 Most Dangerous Ingredient in the World

Jan 08,2025 12:21 pm

-

ON GUARD GOYIM! How To Survive “The Great Taking” In 2025

Jan 08,2025 10:58 am

-

01/06/2025 THE DAY SOVEREIGNTY DIED! TRUMP BEGINS CARRYING OUT THE NWO’S 10 KINGDOM PLAN!

Jan 07,2025 6:15 pm

-

Why Credentialed 501(c)3 Pastors Can’t Sound the Alarm: ON GUARD GOYIM!

Jan 06,2025 11:18 am

-

ON GUARD GOYIM! Dr. Sherri Tenpenny talks about the UN’S “PACT FOR THE FUTURE”

Jan 06,2025 10:28 am

-

Deep State Satanic Super Soldier False Flags, the Black Awakening & NWO Apocalypse

Jan 04,2025 3:00 pm

-

Making CDS the safe, easy way. Andreas Kalcker showing Charlotte Lackney’s 2015 method.

Jan 01,2025 10:50 am

-

From the Fringe: How to To Track mRNA Injected On Android via Their V-MAC Address

Dec 31,2024 10:48 am

-

From the Fringe: Is modern medicine mostly a scam?

Dec 30,2024 10:38 am

-

Replacing a Washer & Dryer: Which is best, Top Load Washer or Front Load?

Dec 29,2024 8:20 am

-

From the Fringe: How “Occupy Mars” is Part of the New World Plan

Dec 28,2024 10:21 pm

-

2024 National Year in Review – The Year of Betrayal and Deceit

Dec 27,2024 5:20 pm

-

From the Fringe: Court Case Verdict – No Proof Of Globe Earth – Twice

Dec 27,2024 9:06 am

-

How did Coca-Cola Influence Santa Claus? Dr. Roy Cassagranda

Dec 24,2024 4:02 pm

-

Making Healthy Organic Peach & Apple Pie Crust & Filling

Dec 23,2024 9:34 am

-

Are the Vatican and Pope Francis opening up Lucifer’s tomb during Christmas Eve ritual?

Dec 22,2024 9:48 am

-

Outside the Birdcage: The Secret Dark Origins of Christmas

Dec 22,2024 9:25 am

-

Covid Hoax: Remembering the Hype, Propaganda, Hysteria, Lies, Abuse, Death, and Destruction

Dec 21,2024 9:18 am

-

HYDROGEN PEROXIDE (H202) KILLS GERMS, PARASITES AND CANCER CELLS

Dec 21,2024 6:58 am

-

Greg Reese: Trump Surrounding Himself with Operation Warp Speed Accomplices

Dec 19,2024 5:01 pm

-

The Kabbalah of Syria. The Coming Battle of Gog and Magog. Deep Analysis by Christopher Jon Bjerknes

Dec 17,2024 10:56 am

-

David Wilcoxson: Revelation Is An Israel Based Prophecy Book

Dec 17,2024 8:17 am

-

Tucker: The Inevitable War with Iran and Biden’s Attempts to Sabotage Trump

Dec 17,2024 7:58 am

-

From the Fringe, Literally: Revealing the Firmament Dome – As Above So Below

Dec 15,2024 12:45 pm

-

Formation Drone Light Show at Stone Mountain Georgia Show Off Drone Sky Image Technology

Dec 12,2024 1:36 pm

-

Professor Walter Veith: Freemason Priesthood of Babylon & Egypt

Dec 11,2024 8:08 am

-

From the Fringe: The Cayenne Pepper Secret Doctors Don’t Want You To Know

Dec 09,2024 12:42 pm

-

Dr. Stan Monteith: Who Runs The World Doublespeak

Dec 07,2024 11:31 am

-

Privacy Cell Phone Gift Ideas: Incognito Tech on eBay for deGoogled Cell Phones

Dec 05,2024 3:07 pm

-

No SIM? No Problem! Best Options Without Using a SIM. Powerful Security Tricks

Dec 05,2024 12:34 pm

-

Michael Snyder: We Really Are Living In The End Times, And 2025 Is Going To Be A Nightmare

Dec 04,2024 1:21 pm

-

From the Forbidden Fringe: THE UNIVERSAL ANTIDOTE DOCUMENTARY

Dec 04,2024 12:59 pm

-

“Abolish the White Race” Compilation of College Professor’s Hate Speech Crimes

Dec 03,2024 7:43 am

-

Is Donald Trump’s Election Good For Christians?

Dec 02,2024 10:33 am

-

Top Brain Surgeon: Blue Light Makes You Fat

Nov 30,2024 4:05 pm

-

Outside the Birdcage: Seeing the big Satanic picture unfolding before us. Mixing Clay & Iron.

Nov 29,2024 10:42 am

-

From the Fringe: How NASA Creates the “Globe” Deceptive Curvature Images & Video

Nov 26,2024 12:51 pm

-

Outside Your Birdcage: The Secret Holocaust of 66 million Russian Christians. Tartaria?

Nov 23,2024 9:01 pm

-

Outside the Birdcage: Triplets Vax’ed – Triple Instant Autism. Can We Trust Vaccines?

Nov 23,2024 9:44 am

-

THE NUCLEAR BOMB HOAX – WHAT REALLY HAPPENED TO HIROSHIMA & NAGASAKI

Nov 22,2024 10:59 am

-

Armageddon Update: Russia’s REVENGE Attack Is Coming! US Embassy Was Evacuated URGENTLY!

Nov 21,2024 12:26 pm

-

DIY Organic BBQ Sauce with Monk Fruit Sweetener, $2 for 12 oz Retail Cost

Nov 20,2024 2:44 pm

-

Armageddon Update: Putin Allows Iran To Attack US Bases With Russian Weapons

Nov 19,2024 7:11 pm

-

The Satellite Deception – A Detailed Documentary – 2024

Nov 17,2024 11:13 am

-

Michael Snyder: Ready Or Not, An Apocalyptic Global War Is On Our Doorstep

Nov 17,2024 10:20 am

-

This Is Why They Won’t Be Able To Block Matt Gaetz, Tulsi Gabbard, Pete Hegseth And RFK Jr.

Nov 17,2024 10:07 am

-

NASA Satanic Fraud and Fakery – $72 Million a day? Why a Trump Space Force?

Nov 15,2024 9:39 am

-

Trump picks Robert F. Kennedy Jr. to be Secretary of the Department of Health and Human Services

Nov 14,2024 4:45 pm

-

It’s clear now that God lifted up Donald Trump to usher in Armageddon – Get your house in order.

Nov 14,2024 4:36 pm

-

The Onion/Deep State won the bid for Infowars – UPDATE: No they didn’t. April FOOLS!

Nov 14,2024 12:21 pm

-

Why Michelangelo Painted Ezekiel on the Sistine Chapel Ceiling So Muscular

Nov 13,2024 8:03 am

-

Outside the Birdcage: The Futurist Deception Blinding Most Christians to the Truth

Nov 11,2024 12:38 pm

-

From the Fringe: Historicist Revelation Timeline Decoded – What Comes Next in 23 Minutes

Nov 10,2024 5:48 pm

-

7 Signs that you are Marked by God | C.S Lewis 2024

Nov 09,2024 6:20 pm

-

From the Fringe: This Trump/Musk Dark Maga Campaign Video Meaning

Nov 09,2024 9:43 am

-

Book of Revelation: Historicist View, Part 1 of 27 – Where are we on the Time-Line?

Nov 08,2024 8:30 pm

-

What DONALD TRUMP’S WIN Means For Us CHRISTIANS.

Nov 08,2024 6:04 pm

-

Rob Schmitt: Donald Trump is an unstoppable force

Nov 07,2024 9:00 am

-

HE WINS! Thank you Heavenly Father! I Didn’t Think God Saved Him To Let Him Lose.

Nov 06,2024 7:56 am

-

Greg Kelly: The country has lost its mind and Election Prayer Request

Nov 05,2024 11:35 am

-

From the Fringe: The Enemy Within Docu-series (All 3 Episodes) Patrick Byrne

Nov 04,2024 10:24 am

-

Prayer Request – “The Glitch is the Rig” – President Trump Disgusted by the Demons Within

Nov 04,2024 7:38 am

-

JUST IN: RFK Jr. Details Work He Wants To Do If Trump Wins: ‘In August, God Sent Me Donald Trump’

Nov 03,2024 11:28 am

-

Desperate Times, Desperate Dems, A Week of Left-Wing Lunacy & Gaslighting Lies

Nov 01,2024 10:37 pm

-

Joe Rogan Experience: J.D. Vance – 2024 Vice Presidential Candidate

Nov 01,2024 9:40 am

-

Historian REVEALS How ROME Fell & Turned Into THE VATICAN/ROMAN CATHOLIC CHURCH

Oct 31,2024 10:01 am

-

Archbishop Vigano: Letter to American Catholics “Kamala Harris is an Infernal Monster Who Obeys Satan.”

Oct 29,2024 8:45 am

-

RFK Jr. Implied Bill Gates Donated $50 Million To Kamala’s Campaign.. He Knows He Will Be Indicted If Trump Wins

Oct 27,2024 9:21 am

-

Reese Report: Your Driver’s License and Organ Harvesting and the Brain Death Fallacy

Oct 26,2024 5:05 pm

-

Joe Rogan Weaves with President Donald Trump – Ignoring the Elephant in the Room.

Oct 26,2024 8:01 am

-

6 Easy Homemade Salad Dressing Recipes

Oct 23,2024 8:31 am

-

Polk County Florida Sheriff Grady Judd News Conference on Human Trafficking Bust

Oct 21,2024 10:12 am

-

Omniwar Symposium | Nanotechnology, The Control Systems Being Deployed Globally

Oct 20,2024 4:34 pm

-

If You Can Only Add One More Spice to Your Collection, Make It Smoked Paprika

Oct 20,2024 1:17 pm

-

Coach Dave Daubenmire: Real Men Would NEVER Vote for Kamala Harris

Oct 20,2024 10:54 am

-

The only thing more Dangerous than Ignorance, is Arrogance! – Albert Einstein

Oct 18,2024 9:16 am

-

Trump on Who Tried To Kill Him, Abortion & More

Oct 14,2024 9:42 am

-

From the Fringe: Square Frequency Patterns In Water Off Anna Maria Island, FL?

Oct 10,2024 9:09 pm

-

Meteorologists – News Sources – MSM Lied About the Severity of Hurricane Milton

Oct 10,2024 9:45 am

-

WW3 Update: What Happened To The Bottom Half of Hurricane Milton? Meteorologists Lying.

Oct 09,2024 1:47 pm

-

WW3 Update: Secret History of Weather Weapons Used For Hurricane Helene and Milton

Oct 08,2024 5:37 pm

-

Prayer Request: Hurricane Milton Peace Be Still! In the name of Jesus Christ

Oct 08,2024 9:08 am

-

WW3 Update: Unusual Radar Signals Coming Out of Florida

Oct 07,2024 1:14 pm

-

WW3 Update: World at War with Criminals Controlling Weather – Dane Wigington

Oct 07,2024 11:39 am

-

WW3 Update: Milton Will Impact Florida As A MAJOR Hurricane (Record Storm Surge Possible On Gulf Coast)

Oct 07,2024 9:28 am

-

Florida WW3 Update: Will Hurricane Milton Be The Next Man-Made Wrecking Ball?

Oct 06,2024 1:10 pm

-

Brace for Another Man-Made Hurricane? Super Tankers Out of Gear (Not Moving) Where the Next Hurricane is Forming.

Oct 06,2024 11:17 am

-

UN Takeover with Chaos & Crisis – Alex Newman. USAWatchdog.com

Oct 04,2024 9:12 pm

-

Have You Noticed The Increase in F-Bomb Speak? Why it’s an Issue.

Oct 04,2024 9:51 am

-

Which Device AI Spies on You the Most: Microsoft, Apple or Google? NOT Who You Think.

Oct 04,2024 9:26 am

-

David DuByne: Disturbing News – North Carolina Collapsing Into a MAD MAX Existence

Oct 03,2024 7:44 pm

-

Old Hospital Pre-Surgery – Peel-A Pound Cabbage Soup

Oct 02,2024 10:19 am

-

From the Forbidden Fringe: Most Banned Fisherman Shows How Hurricane Helene Was Man-Made?

Oct 01,2024 12:53 pm

-

From the Fringe: You Won’t Believe Why Asians Still Eat With Primitive 1200 AD Sticks

Sep 30,2024 5:17 pm

-

The “Comet Of The Century” Is Here! Has God Put It There To Be A “Sign In The Heavens”?